How Do I Know If I Am Covered By a Short Term or Long Term Disability Insurance Policy? This may impact your ability to recover benefits. The long term disability benefits typically will be reduced by your workers compensation benefits, but it usually makes sense to pursue all applicable benefits, including Social Security Disability Insurance (SSDI) benefits, if possible.īeyond this, special rules may apply to your short term disability insurance claim. Rather, if you were injured at work and you cannot return to work for a longer period, you can receive both long term disability insurance and workers compensation. In contrast, long term disability plans cannot do this. Short term disability insurance plans have the right to deny coverage altogether if you are also making a workers compensation claim. Second, short term disability insurance benefit plans often will not apply if you were injured at work. This makes sense because long term disability benefits are meant to cover extended periods of time in which you are unable to work, and seriously injured workers often cannot ever return to their old jobs. Long term disability insurance benefits, however, will continue even if you lose your job. It is much more common for short term disability insurance benefits to continue, even if you lose your job, but you should be aware this may happen.

This means if you become unable to continue working due to a disability and you lose your job because your employer refuses to hold your job for you, your short term disability benefits may end. Aside from this rather obvious difference, there are a few other differences you should be aware of.įirst, short term disability insurance benefits can end if you lose your employment while disabled. Long term disability insurance provides continued benefits if the illness or injury keeps you out of work for a longer period of time. Short term disability insurance provides income replacement if you are unable to perform the duties of your occupation for a short period of time. Key Distinctions Between Short Term and Long Term Disability Insurance In other words, when your short term disability insurance benefits end, your long term disability insurance benefits begin. If your medical condition keeps you from returning to work after the short term disability period ends, then you can transition to long term disability insurance benefits. Short term disability also covers time off due to pregnancy and child birth. As the name implies, short term disability insurance provides replacement income for shorter periods of time when you cannot work. He is still in diapers, is not verbal, and he requires extensive, attentive care.Short term and long term disability insurance provide replacement income if you are unable to continue working due to an illness or accident. The young boy was born with an extra chromosome and has the mental development of someone who is about two years old. The company argued she ought to be able to work because she is able to care for her disabled nine-year-son, Jacob.

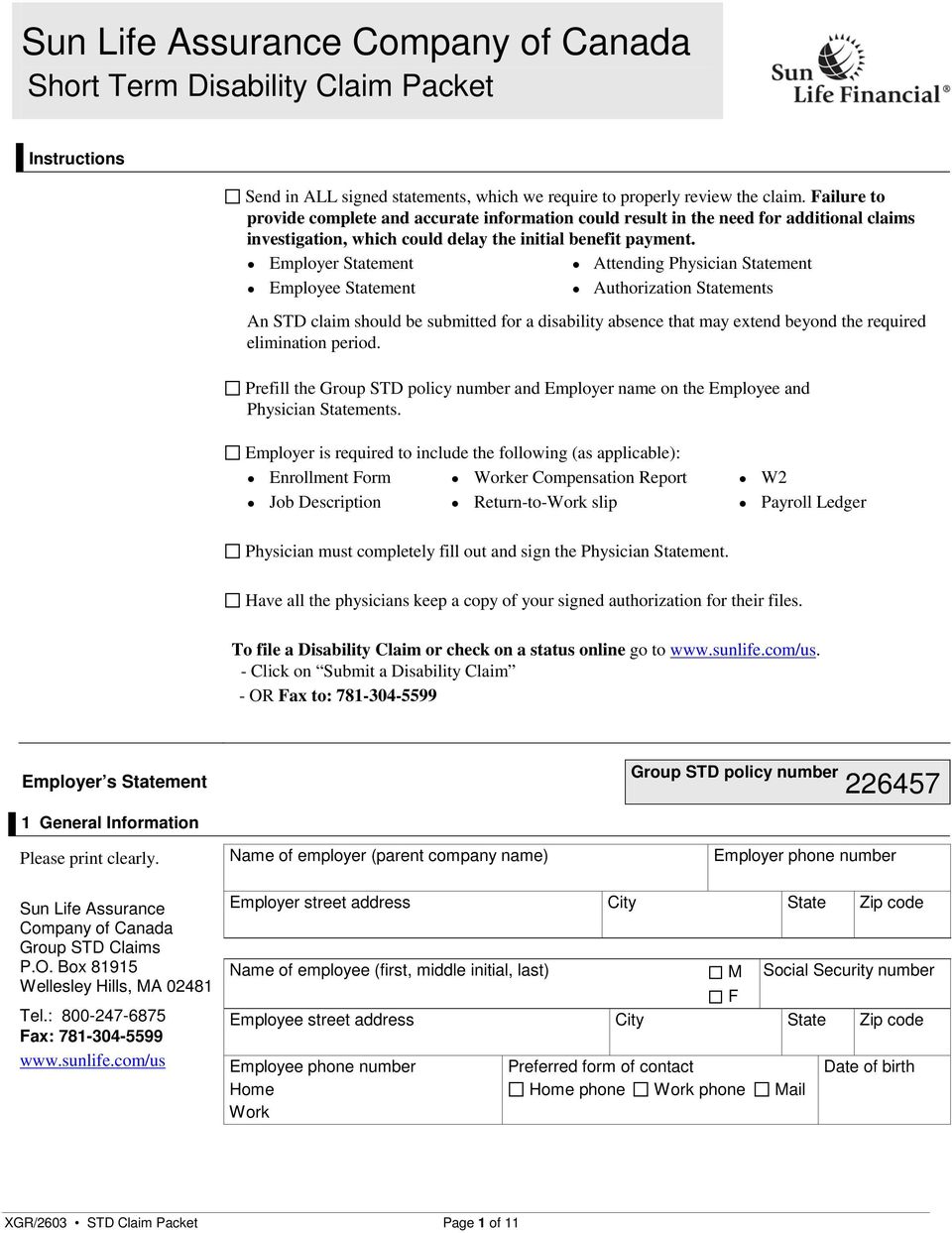

However, after paying her benefits for a year, Sun Life Financial terminated the coverage. Her doctors have determined that she is unable to work because of an anxiety disorder and other physical health issues. Sandra Bullock works in an administration role for a large company in downtown Toronto.

0 kommentar(er)

0 kommentar(er)